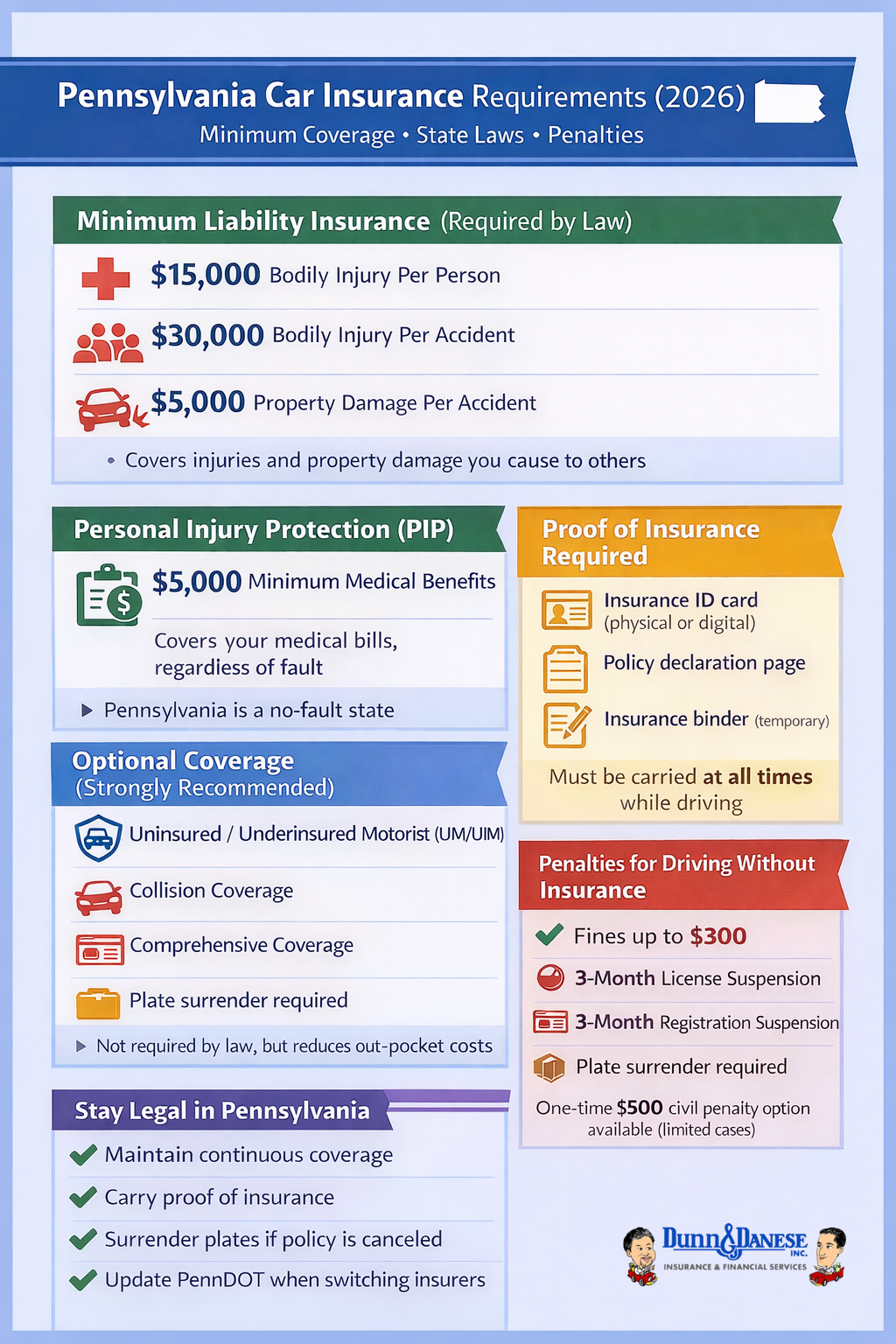

In Pennsylvania, having the right car insurance isn't just advantageous; it's required by law in 2026. At a minimum, drivers must have $15,000 bodily injury per person, $30,000 per accident involving multiple people, and $5,000 in property damage. Additionally, the state mandates $5,000 in first-party medical benefits. Every year, thousands of Pennsylvania drivers face fines, license suspensions, and registration cancellations simply because they didn't understand state insurance requirements. This comprehensive guide breaks down the minimum coverage you must carry, the penalties for non-compliance, and smart ways to stay protected.

Next, let's go over what the minimum Pennsylvania car insurance requirements mean for you.

Minimum Car Insurance Pennsylvania: What You Must Have

Pennsylvania mandates financial responsibility for all registered vehicles, including cars, trucks, motorcycles, vans, RVs, and buses. The baseline liability limits follow a 15/30/5 structure:

$15,000 bodily injury per person

$30,000 bodily injury per accident (multiple people)

$5,000 property damage per accident

Personal Injury Protection (PIP) Requirements

As a no-fault state, Pennsylvania requires $5,000 in Personal Injury Protection (PIP) to cover your medical bills, lost wages, and rehabilitation costs, regardless of who caused the accident. This ensures you receive prompt payment for medical expenses without waiting for fault determination.

Important: PIP does not cover vehicle damage. You'll need collision coverage to protect your car. Many Pennsylvania drivers increase their PIP limits beyond the $5,000 minimum for better financial protection. According to the Pennsylvania Insurance Department, the average PIP claim in 2025 exceeded $8,000, making higher limits a smart consideration.

Always carry your insurance ID card (physical or digital), as it's only valid for periods covered by payment.

Pro Tip: A $35,000 combined single limit can cover bodily injury and property damage combined. These minimums ensure you're accountable if at-fault in a crash.

Proof of Insurance: What Pennsylvania Drivers Must Carry

If you're stopped by law enforcement or contacted by PennDOT, you must be able to show proof of active insurance. Accepted forms include:

Insurance ID card from your carrier (physical/digital)

Policy declaration page (lists vehicles/drivers)

Signed insurance binder (valid 30-60 days)

PA Assigned Risk Plan application

Insurer letter on official letterhead

Insurers report cancellations to PennDOT automatically, but you must notify them of new policies yourself. You can request a free restoration letter online through the PennDOT website with your title and VIN details.

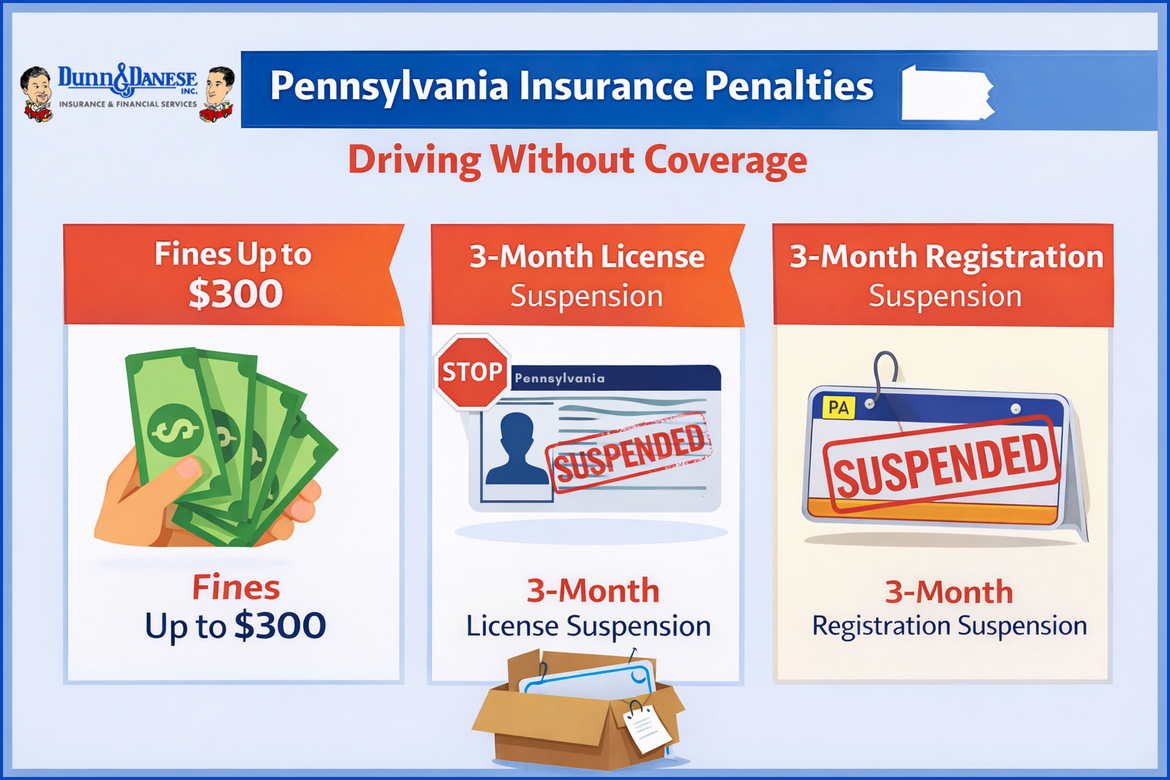

Penalties for Driving Without Insurance in Pennsylvania

Skip insurance? Expect swift consequences. A lapse suspends your registration for three months; surrender plates/card to PennDOT's Return Tag Unit (P.O. Box 68597, Harrisburg, PA 17106). Driving without insurance can result in:

Lapses ≤30 days: Possible waiver if no driving occurred

Driving uninsured: Fines up to $300, 3-month license suspension, impoundment, $50 restoration fee

One-time opt-out: $500 civil penalty + fees via Form MV-222 (once per 12 months)

Appeal within 30 days of notice. Special relief available for sold vehicles (bill of sale), destroyed plates (affidavit), or theft (police report). Even stored vehicles need plates surrendered to avoid suspension.

Optional but Smart Coverages Beyond Pennsylvania's Minimum

While Pennsylvania law sets minimum requirements, insurers must also offer uninsured and underinsured motorist (UM/UIM) coverage. This coverage protects you if you're hit by a driver with little or no insurance, though you may reject it in writing. In Pennsylvania, approximately 8% of drivers are uninsured, making UM/UIM coverage a critical safeguard.

Consider These Real-World Scenarios:

Hit-and-run accidents where the other driver cannot be identified

Deer collisions in rural Pennsylvania counties (over 100,000 annually)

Accidents with drivers carrying only minimum liability limits

Beyond UM/UIM, Consider These Additional Protections:

Collision coverage: Pays for vehicle repairs after an accident, regardless of who's at fault

Comprehensive coverage: Covers theft, vandalism, fire, weather damage, and animal strikes

Rental reimbursement: Provides a rental car while yours is being repaired (typically $30-50/day)

Gap insurance: Covers the difference between your car's actual value and your loan balance

Roadside assistance: Includes towing, jump-starts, flat tire changes, and lockout service

These options aren't required by law, but they can significantly reduce out-of-pocket expenses after an accident.

How to Stay Compliant With Pennsylvania Insurance Laws in 2026

To avoid penalties, maintain continuous coverage and act quickly if a policy is canceled. If you cancel your insurance or sell a vehicle, surrender your license plate within 30 days. For insurance verification, drivers may contact PennDOT by email (ra-dvinscomp [at] pa [dot] gov), phone (717-783-3694), or fax (717-705-0846). Visit the official Pennsylvania Department of Transportation website for forms, verification procedures, and detailed compliance information.

Save Money on Pennsylvania Car Insurance

With rising insurance costs, choosing the right policy matters just as much as meeting legal requirements. Many Pennsylvania drivers overpay simply because they renew coverage without reviewing their options.

DD Insurance helps simplify that process by comparing Pennsylvania-approved insurance policies in one place, so drivers can stay compliant, avoid coverage gaps, and secure competitive rates without shopping around on multiple websites.

Frequently Asked Questions About Pennsylvania Car Insurance

What is the minimum car insurance required in Pennsylvania?

Pennsylvania requires $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, $5,000 property damage liability, and $5,000 in Personal Injury Protection (PIP) medical benefits.

What happens if I get caught driving without insurance in Pennsylvania?

You face fines up to $300, a 3-month license suspension, vehicle impoundment, and a $50 restoration fee. Your registration will also be suspended for 3 months, and you must surrender your license plates to PennDOT.

Do I need to carry proof of insurance in my car?

Yes. Pennsylvania law requires you to carry your insurance ID card (physical or digital) whenever you're driving. You must show it to law enforcement upon request or face additional penalties.

Is Pennsylvania a no-fault state?

Yes. Pennsylvania operates under a no-fault system, which means your own insurance covers your medical expenses through PIP coverage, regardless of who caused the accident. However, you can still sue for serious injuries.

Can I drive in other states with Pennsylvania's minimum insurance?

Yes, but some states require higher minimums. Your Pennsylvania policy will meet the legal requirements in most states, but you may want higher limits for out-of-state travel.

How much does car insurance cost in Pennsylvania?

The average cost for minimum coverage in Pennsylvania is approximately $580 per year, while full coverage averages around $1,847 annually. Rates vary by location, age, driving record, and vehicle type.

Get Help Choosing the Right Pennsylvania Car Insurance

Meeting the minimum requirement is easy. Making sure you're actually protected is where expert guidance matters. At DD Insurance, we compare multiple Pennsylvania-approved carriers to help drivers:

Meet all 2026 state insurance requirements

Avoid costly compliance mistakes

Find better coverage at competitive rates

Get a free Pennsylvania car insurance quote today and ensure you're meeting all 2026 state requirements while getting the best possible rate.

Key Takeaways

Pennsylvania requires minimum liability coverage of $15,000/$30,000/$5,000 plus $5,000 PIP.

Driving without insurance results in fines up to $300, a 3-month license suspension, and registration cancellation

UM/UIM coverage is strongly recommended, as 8% of Pennsylvania drivers are uninsured.

Always carry proof of insurance (physical or digital ID card) when driving

Working with a Pennsylvania-based independent agency like DD Insurance helps drivers stay compliant while finding cost-effective coverage

Related Articles

Pennsylvania Car Insurance Rates 2026: Why Costs Keep Rising

Limited Tort vs Full Tort: What Pennsylvania Drivers Should Know

How to Lower Your Car Insurance Premium in Pennsylvania